The OTT streaming industry enters 2026 at a pivotal moment. After years of rapid expansion, the focus has evolved from pure subscriber growth to sustainability, performance, and long-term engagement. Streaming is no longer an emerging alternative to traditional TV—it is TV for millions of viewers worldwide.

As audience expectations mature and competition intensifies, streaming businesses must balance monetization, user experience, and operational agility like never before. Below are the key OTT streaming trends shaping 2026—and what they mean for media companies, broadcasters, and sports organizations building streaming products.

1. Streaming Is Now the Default TV Experience

For viewers, streaming is no longer a complement to linear TV—it’s the primary way content is consumed. Audiences now expect streaming apps to deliver the same reliability as broadcast television, combined with the flexibility and personalization of digital products.

Nielsen reported that in May 2025, streaming reached 44.8% of total TV usage in the U.S. and surpassed broadcast + cable combined (44.2%) for the first time—a clear signal that streaming is now the default TV experience for audiences.

This shift raises the bar for OTT apps:

- Fast load times and consistent performance are non-negotiable

- App crashes or poor video quality directly impact retention

- UX standards are increasingly influenced by best-in-class consumer apps, not legacy TV platforms

In 2026, streaming apps are judged less as “apps” and more as full-fledged TV services.

2. Hybrid Monetization Is the Industry Standard

While hybrid monetization models aren’t new, 2026 marks a shift in scale, with advertising continuing to overtake subscriptions as a primary driver of streaming revenue and growth.

According to Nielsen, 72.4% of total TV viewing in the U.S. is now ad-supported, spanning broadcast, cable, and ad-supported streaming services—highlighting how central advertising has become to the modern TV and streaming economy.

Key drivers behind this shift include:

- Subscription fatigue pushing audiences toward lower-cost or ad-supported options

- Advertisers prioritizing connected TV for premium reach

- Content owners looking to monetize different audience segments in parallel

For OTT operators, this means monetization strategies must be flexible by design—supporting multiple tiers, offers, and ad experiences within the same app ecosystem.

3. Aggregation Makes a Comeback

After years of fragmentation, the industry is seeing a return to aggregation. Viewers are increasingly overwhelmed by the number of services, subscriptions, and apps they need to manage.

According to Antenna’s 2025 analysis, subscribers acquired through the Disney+ / Max bundle showed a 12-month retention rate of 59%, which is 26 percentage points higher than HBO Max standalone subscriptions—demonstrating how bundling is being used as a powerful retention and churn-reduction strategy.

In response, 2026 is marked by:

- Bundled streaming offerings

- Super-aggregators and telco-led platforms

- Improved subscription management and cross-service discovery

For individual OTT apps, this trend emphasizes the importance of merchandising, content discovery, and flexible packaging—ensuring content stands out whether users arrive directly or through an aggregated experience.

.jpg?width=949&height=333&name=4%20(2).jpg)

4. Sports Continues to Drive OTT Innovation

Live sports remains one of the most powerful forces in streaming. In 2026, sports content is not just a driver of subscriptions—it’s a catalyst for product innovation and advertising demand.

For example, on Christmas Day 2025, Netflix’s livestream of Lions–Vikings averaged 27.5 million viewers in the U.S.—a massive streaming-only audience that shows how live sports can drive extreme OTT concurrency and raise requirements for reliability and delivery at scale.

Sports streaming is pushing OTT platforms to support:

- High concurrency and traffic spikes

- Low-latency, broadcast-grade video delivery

- New viewing formats, including alternate feeds, highlights, and enhanced live experiences that put fan experience at the center—giving audiences more ways to engage with live moments, follow their teams, and consume content on their own terms

For advertisers, live sports continues to offer premium, brand-safe inventory. For streaming platforms, it sets the standard for performance, reliability, and user engagement across all content types.

5. CTV Advertising Matures—but Expectations Rise

Connected TV advertising has moved beyond experimentation. In 2026, programmatic CTV buying, advanced targeting, and new ad formats are firmly established—but so are advertiser expectations.

A majority of marketers, 58% plan to increase their connected TV ad spend in the second half of 2025, outpacing all other media channels and underscoring CTV’s growing importance as a mainstream advertising platform where measurement, targeting, and performance expectations are rising.

The focus is shifting toward:

- Measurement accuracy and transparency

- Ad quality and brand safety

- Seamless ad experiences that don’t disrupt viewing

For OTT operators, advertising is no longer just a revenue add-on—it’s a core product capability that must be integrated thoughtfully into the overall viewing experience, while remaining consistent and measurable across all major connected TV devices.

.jpg?width=949&height=333&name=6%20(1).jpg)

6. UX Becomes Customizable, Not Just Personalized

Personalization has been a buzzword for years, but in 2026 the focus expands to user-controlled and context-aware experiences.

Instead of simply recommending content, leading OTT apps allow viewers to:

- Choose how they watch (live, on-demand, highlights, alternate feeds)

- Adapt interfaces based on content type or moment (live events vs. VOD browsing)

- Engage with experiences that feel relevant without being intrusive

This shift reflects a broader trend toward balancing automation with user control—using automation to simplify discovery while giving viewers flexibility over how they watch.

What This Means for OTT Businesses in 2026

The OTT streaming landscape in 2026 is more mature—and more demanding—than ever before. Winning strategies are built on:

- Flexible monetization models

- High-performance, reliable app experiences that can be tracked and measured

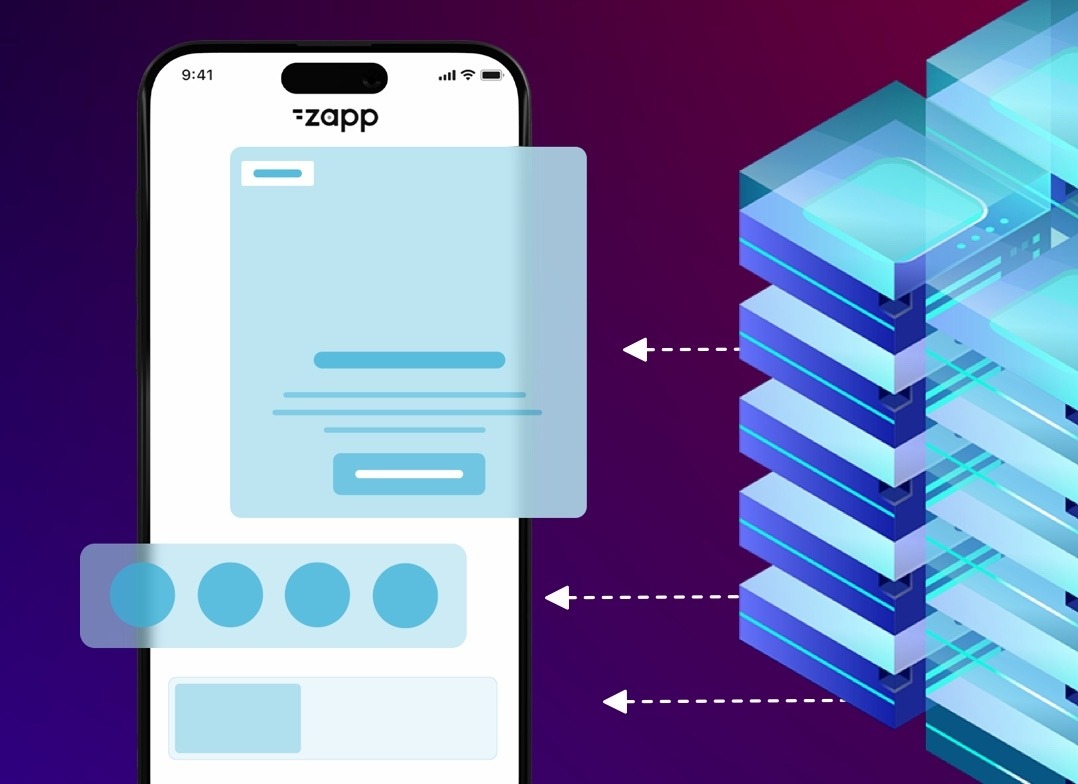

- The ability to iterate quickly as content, audiences, and business models evolve

- [being available across multiple devices]

Streaming success is no longer about launching an app—it’s about continuously adapting it to meet changing viewer expectations and market realities.

As the industry moves forward, the platforms that thrive will be those designed for speed, flexibility, and long-term engagement, rather than short-term growth alone.

.jpg?width=950&height=333&name=2%20(10).jpg)