As 2019 comes to a close it’s not hyperbole to note that we are now firmly in the age of OTT platforms and streaming media. OTT subscriptions are disrupting traditional cable networks and viewers are tuning into streaming services like Roku, Hulu, Netflix and Amazon Prime in record numbers.

That’s where we’ve been. Let’s close out 2019 with nine thoughts on where we are going in 2020.

1. Media companies will experiment with different OTT business models

- 2020 will see more experimentation with bundling and economic models, to create options for viewers to choose the “size” that is right for them.

- Viewers are in the driver’s seat and will drive the direction of the market. The OTT providers that make the right option available at the right price will give viewers a reason to say Yes.

- SVOD pricing alone isn’t enough to pay for quality content: “The whole SVOD ecosystem has got to go through a major change,” Abbot said, “because there’s no way the economic model works if you’re creating this volume of content and getting paid $4.99, $5.99, even $6-$7-$8.99. It’s just too much content at too low a price to be sustainable.”” (Bill Abbot, president and CEO of Crown Media, Hallmark Movies Now’s parent company). However, passionate fanbases may enjoy being able to subsidize the production budget, … kickstarter campaigns may emerge to fund beloved content and involve users in the pre-production phases.

- It’s a lot of work and energy to differentiate the content libraries from HBO Max, Peacock, Hulu, Amazon Prime and Netflix. Users are likely to pick one to two and supplement with multiple niche platforms.

- Magid’s 2019 study shows that consumers have room for 4 paid video services (5 if you’re a millennial) with a total price cap of $42 or ($55 if you’re a millennial)

- Note that Disney+ gets a pass here - it’s a general entertainment MVPD with a great brand (synonymous with kids and families, with exclusive sub properties that have won the hearts and minds)

3. Disney+ will win the streaming wars for signups (renewals will be based on getting and keeping things working seamlessly).

- It’s a general entertainment MVPD with a strong brand (synonymous with kids and families) filled with niche passion brands Marvel, Star Wars, and ESPN, so it will benefit from the best of both mass and passion brand worlds.

- The 2019 video entertainment Pulse Study from Magid showed that nearly half of viewers intend to stay with a streaming service for less than one year at the time they sign up. 23% intend to stay for 30 days or fewer, 11% intend to last 1-3 months and 9% plan to stay for 4-6 months. 43% plan to stay for up to 6 months.

- I predict that Peacock will gain traction with the Olympics and US presidential election, but viewers may not stick around after the election. However, these two major live events will give peacock a huge opportunity to prove itself as an integral part of viewers’ entertainment pie.

4. Acronyms will merge: SAVOD and TAVOD models will emerge as common options as media companies seek profitability in their app offering.

- SVOD will decline … because subscription fatigue and general market confusion (it’s a lot of work to differentiate which service offers which content libraries… and which films and series are contained within)

- While 54% of US viewers say they would leave Netflix if introduced launches ads, we all know what viewers say and what viewers do are two different things. In the US, viewers are also slammed by a whopping 11.2 minutes of ads per hour (Nielsen), so these viewers have an unusually negative take on ads. So long as OTT providers don’t abuse viewers time with 20% of their time spent watching, watching ads, viewers won’t abandon services they enjoy. Just look at Hulu’s various tiers, including opt-in for ads and live programming.

- Kickstarter campaigns, companies like Patreon and donation requests from major media brands have helped users start to understand that subs, ads, or payments help subsidize the content they want to enjoy, and willingness to contribute to content costs is growing.

5. New service overview industries will emerge, like Just Watch and Reelgood to help viewers make sense of where to find the content they seek. Will we see a match.com taking into account a total budget, demos living in the household, knowledge of the various skinny bundling options and pricing tiers and interests?

6. Brands will get savvier holding onto WW rights for titles the own, and national borders will further blur. This will expand audiences without additional distribution costs (note, marketing costs are not considered here) and we’ll see ”diaspora” and “---phile” content becoming passion plays with audiences. BritBox, a joint venture between the BBC and iTV have brought British content to streaming audiences in the UK, Canada and the US. Over 650k anglophiles in the US have signed up for the service.

7. Brand will be King, Metadata will be Queen

- When consumers are confounded with too much choice, a strong brand essence becomes a helpful heuristic for interested viewers.

- Knowing that consumers have a limit to the number of subscriptions they’ll take on, as well as the number of apps they’ll allow onto their personal devices, gaining attention and then action will be crucial to OTT streaming channels’ success.

Monetization and business models are the talk of the industry, and we will be hearing more about how to use a variety of metadata services to deliver different feeds of personalized, relevant content to interesting viewers. Going back to the stat about people’s lack of intent to stay with a streaming service for more than 6 months, capturing viewers isn’t enough… apps and streaming services will need to work to keep viewers returning. This will be by adding great value, including surfacing relevant and diverse content to different viewers according to their preferences.

8. Media apps will begin to leverage their valuable feedback loop with viewers.

I’m not talking about second screen fun and games (where viewers take polls and use app as one of many voting mechanisms for their favorite singer in a competition), rather media companies will ask their app users about their preferences, and use this as a factor in determining the content they create and business strategy.

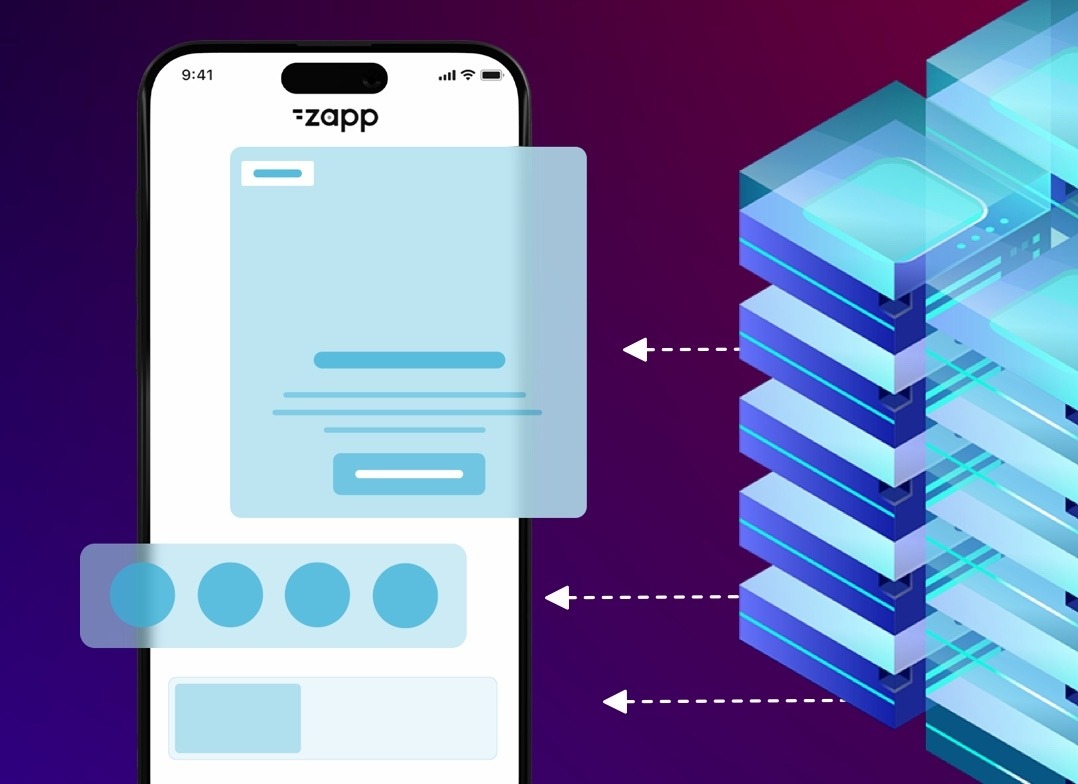

9. Media companies won’t launch apps, they’ll launch app lifecycles. Getting to launch is just the beginning of building a valuable, sticky relationship with viewers. Media companies will need to innovate, iterate and grow their offering over the course of their relationship with viewers if they want to retain their hard-won users. The need for change will need to be baked into how apps are made and maintained, and companies will be asked to grow their offering, supported platforms and functionality while maintaining headcount costs. The industry will innovate to add speed and scale in 2020.